A bounty of untapped potential

Raymond James Investment Banking Senior Managing Director and Head of Business Development Ken Grider shares insight on the potential advisors create for themselves and their high-net-worth clients when they integrate investment banking into their wealth advisory practices.

Even before his career officially started, Ken was exposed to corporate finance while at Emory University, and later while earning his MBA at Wake Forest. It intrigued him how finance and the use of capital played an important role in almost every business decision. After graduating and spending 12 years with a corporate finance consulting firm and later serving as a partner in a private equity firm, he never looked back.

Today, Ken and his team manage the investment bank’s relationships with legal and accounting firms; venture, mezzanine and lower market private equity funds; and Raymond James’ more than 8,700 financial advisors.

“I have always been fascinated by working with big personalities who start companies and aspire to change industries. If you’ve spent time with entrepreneurial business owners, you know there is a special type of confidence and drive at work there – a type of personality I’ve always been drawn to,” Ken said.

Investment Banking works with advisors across all Raymond James affiliate channels, helping them respond to the capital needs and/or liquidity goals of their business owner clients and prospects.

“If you bring us in, we want it to look and feel like our services are being introduced by you to help your business owner relationships grow to their full potential or to monetize the businesses,” he said.

By partnering with Investment Banking, advisors can rely on the guidance of firm professionals to confidently answer the questions of their business owner clients, such as “What is my business worth?” or “Which options are available to grow, sell or take my company public?”

“That’s what we do – we partner with advisors to respond to business owners’ questions and needs,” Ken said.

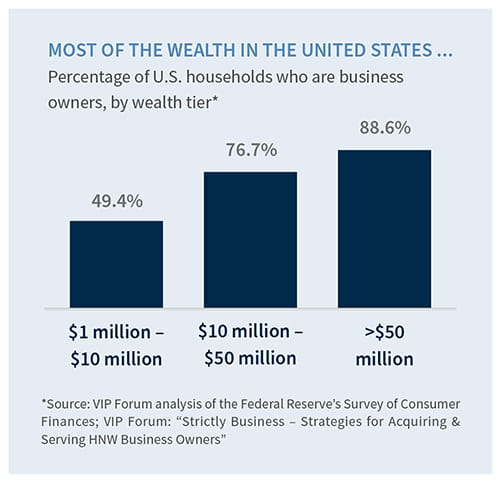

Ken explained that there is a strong connection between business owners and high net worth. If you’re talking to a high-net-worth or ultra-high-net-worth prospect or client, chances are you’re speaking with a business owner (see chart above).

Many advisors who are successful in attracting high-net-worth business owner clients often get their feet in the door by first working with these prospects on their businesses. Once an advisor differentiates their practice and demonstrates the ability to add value to a prospect’s business, the conversation can

transition more smoothly to wealth management. “Adding value to the business first opens up the personal planning discussion,” Ken said.

Business owners love to talk about their businesses. However, some advisors may fear they don’t have the depth of understanding required to maintain their professional status in these clients’ eyes when it comes to business planning. “When you’re out of your ‘power alley’ and business owners start to ask questions beyond your realm of expertise, advisors can feel vulnerable. That’s why we’re a resource – to provide that guidance,” Ken said.

Investment Banking has created a user-friendly environment and set of protocols to ensure confidentiality. Advisors are encouraged to reach out and ask questions even before they bring up Investment Banking in conversation.

Education from all angles

The numbers show that partnering with Investment Banking and the Private Wealth teams at Raymond James can differentiate an advisor’s practice and drive greater client value, practice revenue and AUM growth. However, not all advisors have the confidence and knowledge to bring up Investment Banking with their business owner relationships. That’s why Ken and his team created the Institute for Business Owner Excellence (or IBex), so advisors can gain the knowledge to successfully engage with high-net-worth business owners. IBex’s components include an annual December conference, webinars, and small master-class groups with a roundtable format that facilitate the sharing of best practices and successful experiences.

Purposefully developed, these experiences teach advisors the benefits of working with Investment Banking, along with strategic ways to incorporate the investment bank into their businesses.

Tap into untapped potential

The time is right to step into a partnership with Investment Banking. Ken described the current environment as “the perfect storm,” with forces working to drive business valuations to near all-time highs, unprecedented transaction volume, market uncertainty, and the concern some owners have expressed about possibly “missing” the opportunity to sell when so many others are.

A business owner may be thinking: “Values are high for my business now. If they fall, will I have to wait through a long cycle for the value to come back before I feel comfortable selling?”

There is also the risk of taxes going up. This might cause business owners, even those with growing businesses, to consider whether waiting to sell means they’ll take home less in the future due to higher taxes and/or lower selling multiples.

Needless to say, business owners are asking lots of questions these days, and Investment Banking could be the right partner to help advisors answer them.

A record number of Investment Banking transactions referred by advisors – which resulted in record referral fees in 2021 – are driving increasing interest in partnering with the group. “We are proving that advisors can systematically introduce a high-net-worth business owner focus into their practices that is fully integrated with Investment Banking,” Ken said. “Advisors implementing these programs are differentiating their practices and seeing success in the high-net-worth space.”

To sum up the current environment, Ken shared a sentiment from CEO Paul Reilly: It’s incumbent upon us in the planning process to bring the full value of our firm to clients. For business owners whose businesses may be their most valuable asset, Investment Banking helps deliver the maximum value of Raymond James.

You have questions. Investment Banking has answers.

How do I start the conversation?

Prep for client meetings by having a pre-conversation with Investment Banking. Ask things like: Do we do these types of deals? What’s going on in my client’s industry? Have any big deals recently closed in their sector? What headwinds or tailwinds do you see?

What if I’m worried about being cut out of the process?

When an opportunity arises, the Investment Banking team makes it a point to be thoughtful and include advisors in the discussion. When a new opportunity is introduced to the investment bank, advisors first interview cut with the bankers and then create a game plan together for how best to move forward.

What’s the immediate benefit?

Referral fees are just one benefit and are based on a percentage of Investment Banking’s fee. What’s more, advisors can be paid up to three times per transaction, over the course of multiple transactions. And don’t forget the assets advisors can then tap into on a personal wealth level.